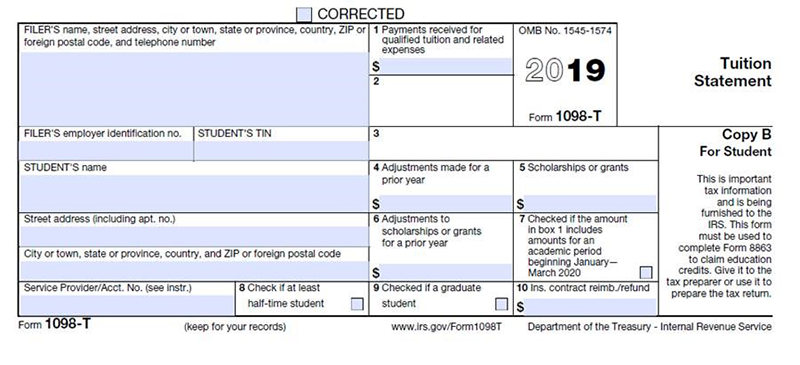

Non-taxable incomeįinancial aid used solely for tuition, fees, books, and/or required course equipment and supplies is not taxable. If you have questions about your information, contact Student Fiscal Services. Any scholarships, fellowships, and grants you received in the prior calendar year will be listed in Box 5. The form will list your tuition and related fees paid in box 1. If you have not opted out of receiving a paper copy, it will be mailed to you during the last week of January. Your 1098-T form is available online through MyUW. For guidance, please consult a tax advisor. You may claim up to $2000 for qualified education expenses depending on your income level.ĭepending on your individual circumstances, there are additional tax credits and deductions that may be better for you. The Lifetime Learning Credit helps parents and students pay for undergraduate, graduate, and continuing education. Even if your income level was not high enough during the year to incur federal income tax liability, up to 40 percent ($1,000) of the tax credit can be received as a refund.

You may claim up to $2,500 for this credit if you meet the income requirements and are attending school at least half-time.

The American Opportunity tax credit applies to the first four years of your undergraduate studies. Tax credits you might be eligible to claim If you are claimed as a dependent on another person’s (such as your parents) tax return, only the person who claims you as a dependent can claim a credit for your qualified educational expenses. Congress continued the federal income tax credit available to students and their families with tuition and other eligible college related expenses. If you do not normally file a federal tax return, you might consider filing this year. Higher Education Emergency Relief Fund II.Higher Education Emergency Relief Fund III.Glossary of Terms for Aid Offer Notifications.

0 kommentar(er)

0 kommentar(er)